BUY

We have been assisting local buyers and out of town buyers, including buyers from out of the country such as Canada, UK, Brazil etc. We have a process to ensure that you get exactly what you are looking for. We take the time to sit down and go over your situation, areas of interest, price range, must haves, would like to have, timeline etc…

On your first contact we provide you with lot of information so you are educated and equipped with the neighborhood area, home styles, typical layout etc. We also make sure you are per-qualified by a lender, bank or a credit union. If not then we assist you in referring you to some lenders we work with. These are local lenders and you can walk into their office and talk to them unlike getting approved over the phone and no customer service after the first contact.

Types of Properties to Buy

NORMAL SALE

These kind of homes are sold by individuals as a normal sale. That is because it is a sale by one person to another person with no banks, or short sale contingencies are involved..

BANK OWNED PROPERTY

These are the properties that banks/lenders have foreclosed on individuals because either the previous owner could not pay off the loan or just walked away from the property. In any case the property.

FORECLOSURE

When an individual cannot pay the mortgage as agreed, and falls behind on payment, he or she can let the bank know that he is not able to pay the regular installment in full. (write more info here……)

SHORT SALE

When an individual cannot pay the mortgage as agreed, and falls behind on payment, he or she can let the bank know that he is not able to pay the regular installment in full. If the individual decides that he/she does not want to or cannot afford to stay in the house and make payments, with the bank’s permission he/she can put the property for sale. It is with a contingency that the bank will try to get the most on the property to recover the shortage on the loan amount. That is why it is called a Short Sale.

RENT-TO-OWN

You always wanted to buy a house but cannot afford to pay for the down payment or you were affected by a bankruptcy and therefore, the lenders would not give you a loan, you have come to the right place. We have an excellent program (for certain areas only) where if your combined income is more than $50,000 per household and meet other criteria, you could be qualified to “Rent-to-Own” program. Call to make an appointment to go over the program details..

PRE-FORECLOSURE

When an individual cannot pay the mortgage as agreed, and falls behind on payment, he or she can let the bank know that he is not able to pay the regular installment in full. Early stages of foreclosure process is called Pre-Foreclosure. At this stage the owner has tried everything to either sell the property on an open market or via short sale but could not sell it for whatever reason, then the bank gives him/her an opportunity to do a loan modification under programs such as HAMP.

Home Buyers Need These 4 things!

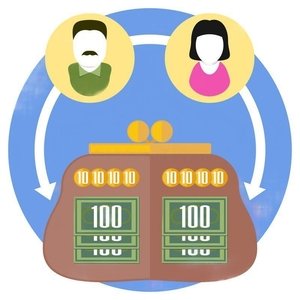

CASH

CASH

As one cannot imagine buying a house without cash or some sort of down payment. It is crucial to ensure that you have enough cash for Escrow, Down Payment, Closing Costs, Moving Costs etc.

How much cash is needed? It depends on the purchase price, and your comfort level of obtaining the loan with payback ability over certain time period. In most cases, people prefer to go with 30 years loan so the monthly payment is comfortable on monthly basis.

CREDIT

![]()

CREDIT

Unless you are buying the house all cash, then credit is not an issue. But if you are getting a loan, then credit is very important. The lender is going to look at your credit score (actually all 3 Credit Bureaus – Experian, Equifax, TransUnion) and look at the middle score of the three. This determines how credible you are in terms of them giving you the loan. Depending on the market and the lenders, generally the lenders prefer to have more than 640 as your score.

INCOME

INCOME

One should have some sort of income in terms of business income or salaried income or other sort of income. Level of income is also very important because with steady or regular income one cannot survive, save and be in a position to buy a house. So the level of income is also looked at by the lender.

DEBT TO INCOME RATIO

DEBT TO INCOME RATIO

One may have Cash, Credit and Income but if he has too much debt that makes it tough to make payments towards the debts and also the monthly payment (debt arising from the purchase of the home) the lender will not likely take the risk of lending you the money to purchase the house. There are lenders who would lend but others may not. The Debt to Income ratio should be as low as possible. Meaning debt is low and the income is high comparatively.

So What Next?

Next Step

If all of the above factors are looking good then you are pretty much ready to qualify for a loan and ready to buy a house in the price range you may want. Note Cash, Credit, Income and Debt-to-Income Ratio are major factors but depending on your situation such as if you had a bankruptcy or late payments, temporary loss of income, change of job, change of profession or type of work etc may impact in obtaining the loan from a lender.

Here I am trying to EDUCATE the BUYER as to which factors are important and how they may help you in getting a Pre-Qualification letter from the lender.

So the NEXT STEP is to set up a time to go over these factors and understand where you stand and determine your next step.